- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

This Penny Stock Just Jumped 750%. Can It Retain These Gains for the Long Term?

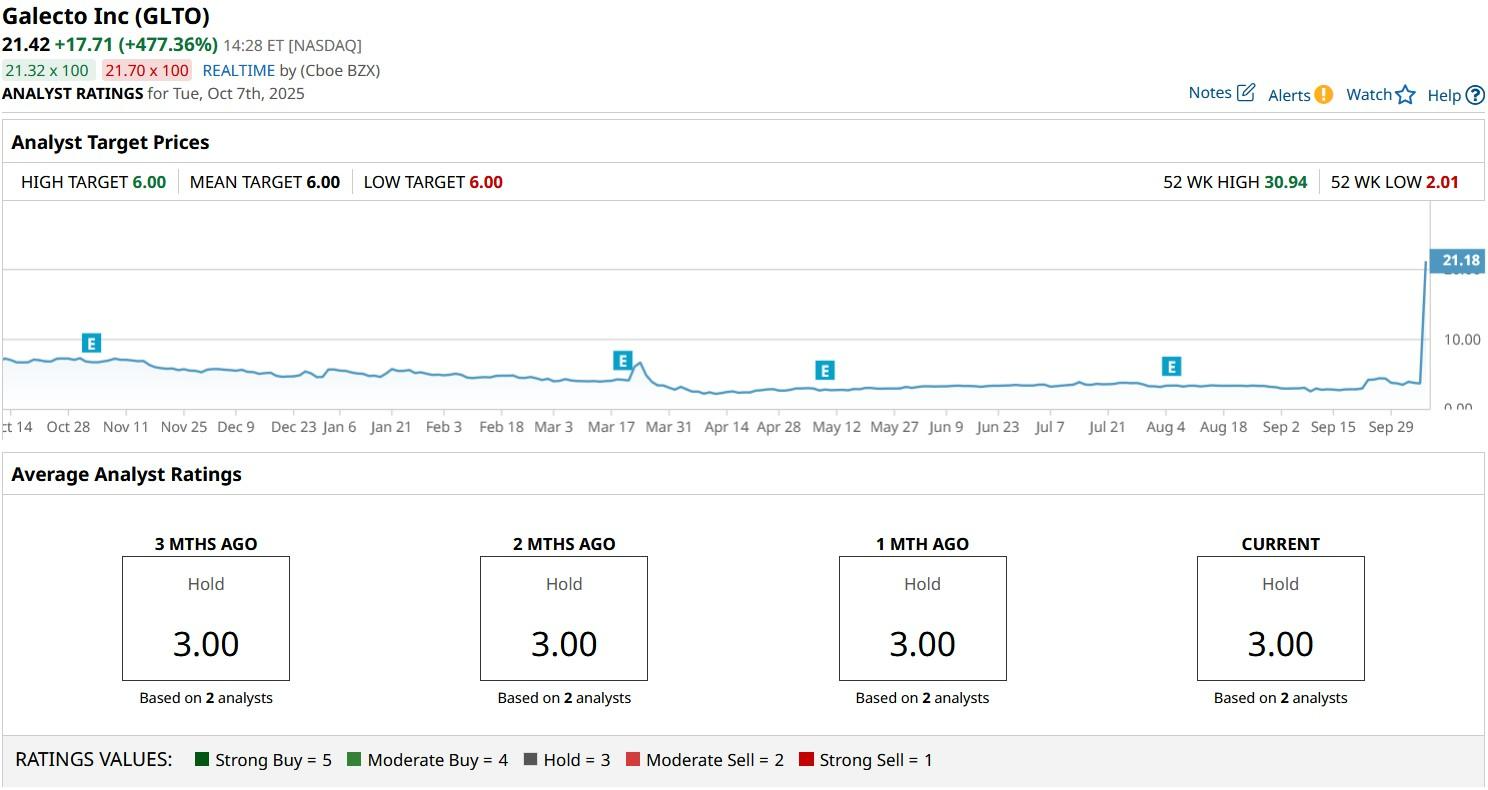

Galecto (GLTO), a small-cap biotechnology company, saw its shares soar as much as 750% on Tuesday as retail investors flocked into them for no apparent reason.

The massive surge in trading volume resembles a meme stock rally given GLTO didn’t post a new press release or regulatory filing, neither did it receive bullish analyst coverage today.

While GLTO stock has pulled back rather significantly in recent hours, at one point on Oct. 7, it was seen trading 1,500% above its year-to-date low.

Galecto Stock Could Reverse These Gains Just as Quickly

Galecto’s cosmic run has pushed its valuation into speculative territory, with shares now up more than 750% from their April lows.

Yet the company’s fundamentals remain unchanged. The company does not generate any revenue does not have an approved product. GLTO’s pipeline, focused on fibrosis and oncology treatments, is in early clinical stages, with its most advanced candidate just beginning a Phase 2/3 trial.

Therefore, the pop in this biotech stock appears entirely sentiment-driven, not backed by earnings, partnerships, or regulatory progress. Such disconnects between valuation and fundamentals often end in sharp reversals.

Without a clear path to profitability or material news, GLTO’s price looks unsustainable and vulnerable to steep downside.

Why Investors Must Remain Cautious on GLTO Shares

Caution is warranted in buying Galecto shares at current levels also because the biotech company’s financials paint a concerning picture for long-term investors.

In its latest quarterly filing, GLTO recorded less than $15 million in cash and equivalents with a burn rate that could exhaust reserves within a few quarters.

In the absence of revenue, the management will likely have to raise capital, potentially via dilutive stock offerings that could erode shareholder value.

Unless Galecto secures non-dilutive funding or a strategic partnership, its balance sheet remains a major risk. Retail investors chasing momentum in GLTO stock may find themselves holding the bag when reality sets in.

Wall Street Is Super Bearish on Galecto Shares

Another major red flag in owning GLTO shares at current levels is that they’re not broadly covered by Wall Street firms.

Galecto shares currently receive coverage from only two analysts, and even they rate it at “Hod” only with the mean target of $6 indicating potential downside of more than 65% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.